Buying a brand-new car is very expensive these days!

Signing on the dotted line and committing to a repayment plan, over 60 months, is also a huge financial commitment in tough economic times, even with the added attraction of a large balloon repayment at the end of the finance agreement.

So, for the majority of South Africans who have the luxury of even owning a vehicle, sticking with your “tried and tested” car is Hobson’s choice… No choice at all.

You’d need to replace it, but what if you don’t have the spare money lying around?

Please remember your comprehensive vehicle insurance policy does not cover mechanical failure – it covers accidents, fire and theft.

So, if your engine blows up and you’re left stranded on the side of the highway, you might be able to call your short-term insurer to have your car towed somewhere, but you won’t have a valid claim with them.

It’s really simple. There is a comprehensive list of car parts that are covered in the policy like the engine, gearbox, differential, clutch, and CV joints, just to name a few.

Each listed car component has a benefit value attached to it.

For example: An engine could be covered to the value of R53,000 (plan dependent). If you claim against a car part covered in the policy, the benefit amount listed gets paid out.

The only factors that impact the amount of cover offered per car part are:

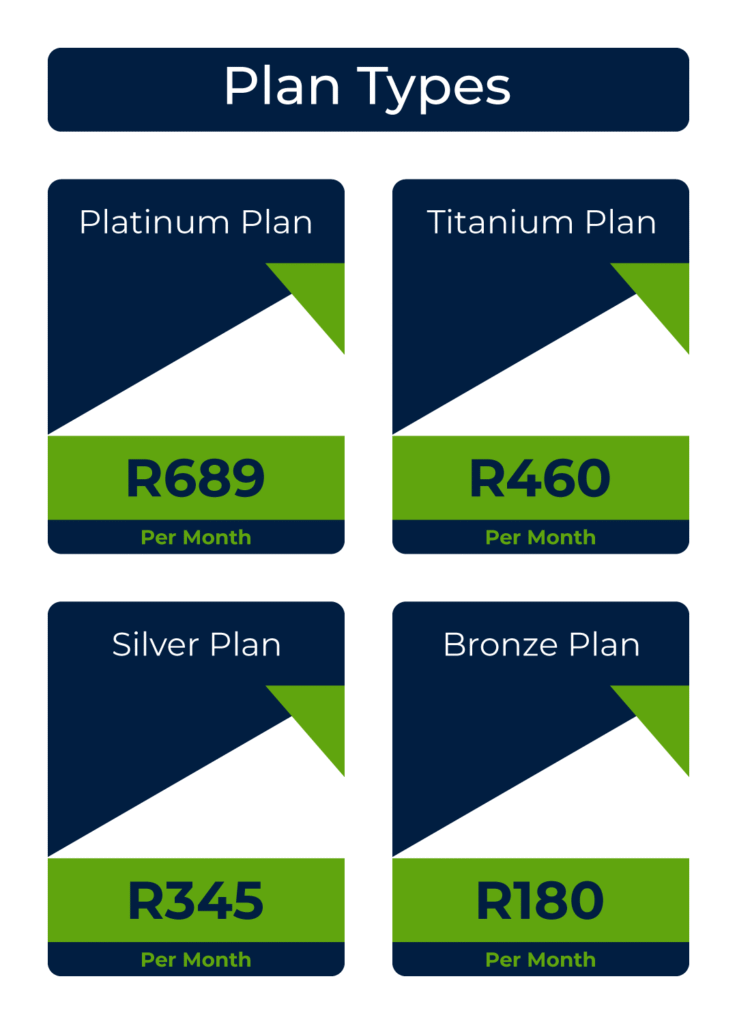

*Premiums may be reviewed annually.

At the end of the blog post is a downloadable brochure that makes comparing the plans and car component cover very easy. Make sure you run your own cost-benefit analysis.

Besides paying your premiums on time, when you take out a Mechanical Warranty policy, you are responsible for ensuring that car services are carried out regularly.

Only passenger vehicles younger than 12 years, with less than 220 000 km on the clock, will be covered.

There is no excess at the claim stage.

There is a waiting period of 90 days before you can claim against the policy. Regrettably, no settlement for mechanical breakdowns during this period.

If multiple car components fail within fourteen days or 1000 km of each other, your claim will be treated as one claim and GENRIC will only pay out for the one component with the highest maximum benefit.

From the engine to the gearbox, trust us to keep you on the road!

GENRIC Insurance Limited (FSP: 43638) is an Authorised Financial Services Provider and licensed non-life Insurer.

Enter your details to request a call back.