Millions of us are looking for ways to maintain access to private healthcare without breaking the bank.

Medical aid plans are very expensive these days and most South African public healthcare services are unfortunately under immense pressure with overcrowding, long waiting lists, and a general shortage of resources and expertise.

Health Insurance to the Rescue

Health insurance is becoming an increasingly popular alternative in South Africa, providing a more affordable solution, with various coverage options.

Carl Moodley, Chief Information Officer of GENRIC Insurance Company Limited, mentions that the demand for basic health insurance plans has skyrocketed over the past three years. “Whether you need basic primary care for day-to-day needs, hospital-only coverage, accident and emergency care, or comprehensive plans that cover both day-to-day and hospital benefits, there’s something for everyone.”

It’s a good question so we’ve listed the major differences between them below.

Comprehensive Coverage: Medical aids provide extensive coverage for a wide range of medical services, including hospitalisation, surgery, specialist consultations and chronic conditions.

Prescribed Minimum Benefits (PMBs): Medical aids must cover 270 in-hospital procedures and 26 chronic conditions, which all members pay for, regardless of usage.

Higher Cost: They’re generally more expensive due to the mandatory inclusion of PMBs and the comprehensive nature of the coverage.

Regulation: Heavily regulated, ensuring a standard level of care and protection for members.

Unlimited Benefits: Provides more comprehensive and often unlimited benefits for covered conditions and procedures – if you choose a top plan.

Member Contributions: Contributions are typically higher to cover the extensive range of services and PMBs.

Defined Coverage: Pays out a specific amount for predefined health events or conditions as outlined in the policy.

Flexible Plans: Offers a range of plans, from basic primary care to comprehensive options, allowing customisation based on individual needs and budget.

Lower Cost: Generally, more affordable due to the modular nature of the plans and the ability to select specific coverage.

Less Regulation: Not as heavily regulated as medical aids, providing more flexibility in coverage options.

Benefit Limits: Coverage is subject to defined annual benefit limits, meaning there may be caps on certain benefits or services.

Modular Design: Allows you to build your coverage based on what you need, such as day-to-day GP visits, dental, optometry, and hospital events.

Specific Payouts: Health insurance policies pay a fixed amount towards specific health events, such as a doctor’s visit, medication, hospital procedures, emergencies or accidents, up to the defined limit in your policy. This allows for more predictable out-of-pocket expenses.

If the answer is “Yes” then please continue on.

Seven plan options allow you to choose healthcare coverage that best suits your budget and needs. There are varying levels of out-of-hospital Primary Healthcare benefits that can extend to in-hospital private healthcare benefits.

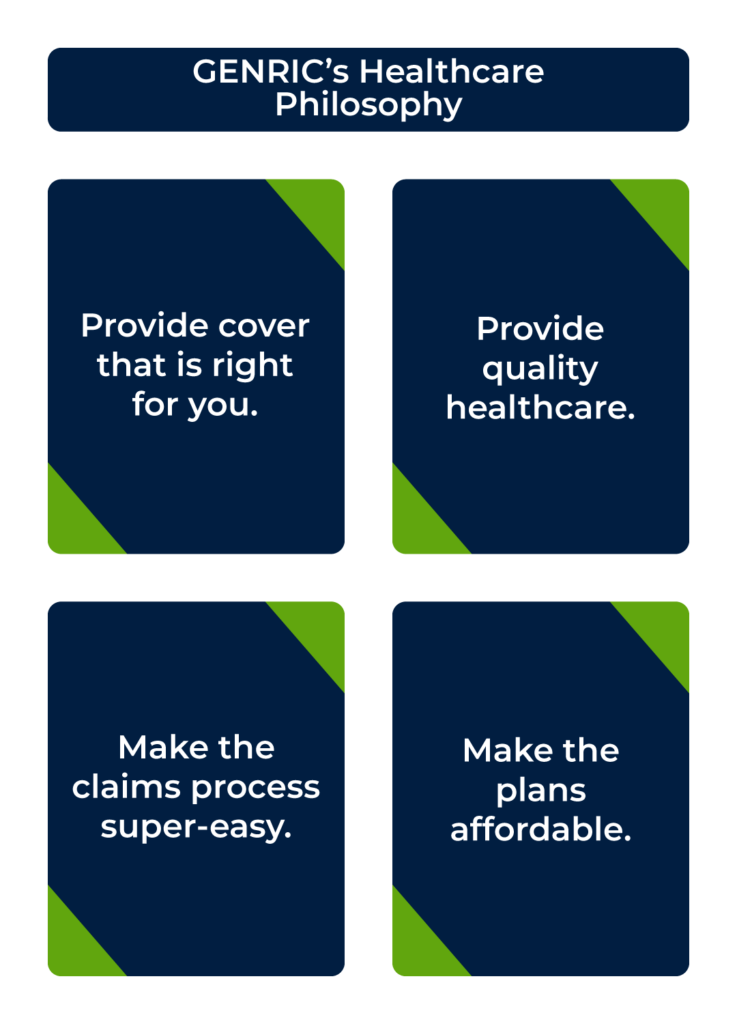

Underpinning everything is GENRIC’s “Quality Healthcare for All” philosophy, which at its core, has four pillars:

In a nutshell, health insurance offers a flexible, affordable alternative to traditional medical schemes. With the state of public healthcare in decline and economic pressures rising, it’s worth considering if you need a practical solution to ensure you and your loved ones have access to quality healthcare when it matters most.

Trust us with your health insurance needs.

GENRIC Insurance Limited (FSP: 43638) is an Authorised Financial Services Provider and licensed non-life Insurer.

Enter your details to request a call back.